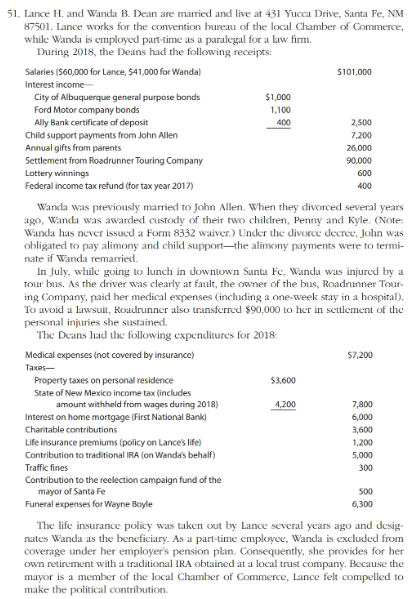

new mexico pension taxes

No other government benefits eg Medicare Medicaid TANF food stamps are taxed. Tax Analysis Research Statistics.

Effort To Eliminate Social Security Tax Gains Momentum The Nm Political Report

File your taxes and manage your account online.

. E-File Directly to the IRS State. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. Were one of only 13.

NMERB is required to use the code 1 on your 1099-R. Your Online Tax Center. States do not tax social security income for retirees.

If you do not have to file a federal return be-cause your income falls below IRS minimum require-ments. Your Online Tax Center. NMERB previously coded these 1099- Rs with a 2.

They can also be taxed on their 401 K distributions. You are 65 or older. However depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each.

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. Low-income taxpayers may also qualify for a property tax rebate even if they rent their primary residence. 1099-R forms for pension or an-.

Free 2020 Federal Tax Return. Does New Mexico offer a tax break to retirees. The New Mexico income tax has marginal rates from 17 to 49 on a couple with 24000 income.

Rules for filing taxes in New Mexico are very similar to the federal tax rules. Marginal Income Tax Rates. New Mexico Taxpayer Access Point TAP.

Is my retirement income taxable to New Mexico. New Mexico does not however require the payors of such income to withhold New Mexico income tax unless requested to do so by the recipients of the payments. 52 rows 40000 single 60000 joint pension exclusion depending on.

Pension and annuity income of a New Mexico resident is subject to income tax in New Mexico but New Mexico not require payers to withhold state income tax on pensions and annuities unless the payee requests the report withholding tax a payer must be registered with ing System CRS. Personal and Business Income Taxes Gross Receipts Tax Weight Distance Tax and more. The majority of US.

Military pensions might be eligible under this exemption. ALBUQUERQUE New Mexico KOAT Republican lawmakers are looking to eliminate a tax for retirees. Ad e-File Free Directly to the IRS.

The income of New Mexico residents from pensions and annuities is subject to New Mexico personal income tax. There is a modest reduction in taxes for people 65 or over with incomes less than 51000 couples. For tax year 2021 that means single filers can claim a standard deduction of 12550 and joint filers can.

High earners individuals who have income above 210000 and couples that file jointly with income above 315000 will be subject to a. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. It also comes in fourth in terms of.

E-FIle Directly to New Mexico for only 1499. The New Mexico Legislature on Thursday passed a bill eliminating taxes on Social Security benefits for individuals with less than 100000 in annual income or couples with less than 150000 in. Low-income taxpayers may also qualify for a property tax rebate even if they rent their primary residence.

Property Tax Rebate for Personal Income Tax. However for 2021 taxes a new bracket is being introduced. New Mexico personal income tax return if the Internal Revenue Service IRS requires you to file a federal return.

New Mexico is one of only 12 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and then they are taxed again on the benefits they receive. Forming Tax Increment Districts. Confidentiality of Tax Return Information.

The town ranks third among the best places to retire in New Mexicowhen it comes to medical centers with 285 per 1000 residents. Deductions both itemized and standard match the federal deductions. SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support.

Click Here to Subscribe. During the 2020 legislature bills were introduced on Think New Mexicos three recommendations to improve retirement provision in New Mexico. You are not 65 but are considered blind for federal tax purposes.

Does New Mexico offer a tax break to retirees. By exempting veterans retirement pay from state income tax they can keep more of what they earned for their selfless. All NM Taxes.

The bill would support retired veterans by making up to 30000 of their military retirement pay exempt from state income tax. In states that do not tax Social Security a retirees benefits may still be subject to income-tested federal taxes. It ranks towards the middle of this list with a tax rate of 1760.

According to the New Mexico Taxation and Revenue website Military Retirement is taxable and is included in gross income on the return. Introducting NM Taxation Revenue Department Notification Service. If you are a New Mexico Educational Retirement Board NMERB retiree who is under the age of 55 please note.

Michelle Lujan Grisham a Democrat signed House Bill 163 exempting. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted gross income if you meet one of the following. The 1099-R tax document for retired members were mailed January 27 2021.

New Mexico Retirement Tax Friendliness Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

37 States That Don T Tax Social Security Benefits The Motley Fool

Solved 1 Lance H And Wanda B Dean Are Married And Live At Chegg Com

New Mexico Lawmakers Ok Crime Bill 500m In Tax Rebates New Mexico News Us News

New Mexico Estate Tax Everything You Need To Know Smartasset

New Mexico Retirement Tax Friendliness Smartasset

Montana Retirement Tax Friendliness Smartasset

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Estate Tax Everything You Need To Know Smartasset

Solved Lance H And Wanda B Dean Are Married And Live At Chegg Com

Can I Claim My Parent As A Dependent The Turbotax Blog

Map Here Are The Best And Worst U S States For Retirement In 2020

Here Are The U S States With No Income Tax The Motley Fool Income Tax States In America Income

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Spring Break Getaways

New Mexico Income Tax Calculator Smartasset

The Best States To Retire In The U S In 2022 Personal Capital